India's consistent good performance a big boost for economic growth

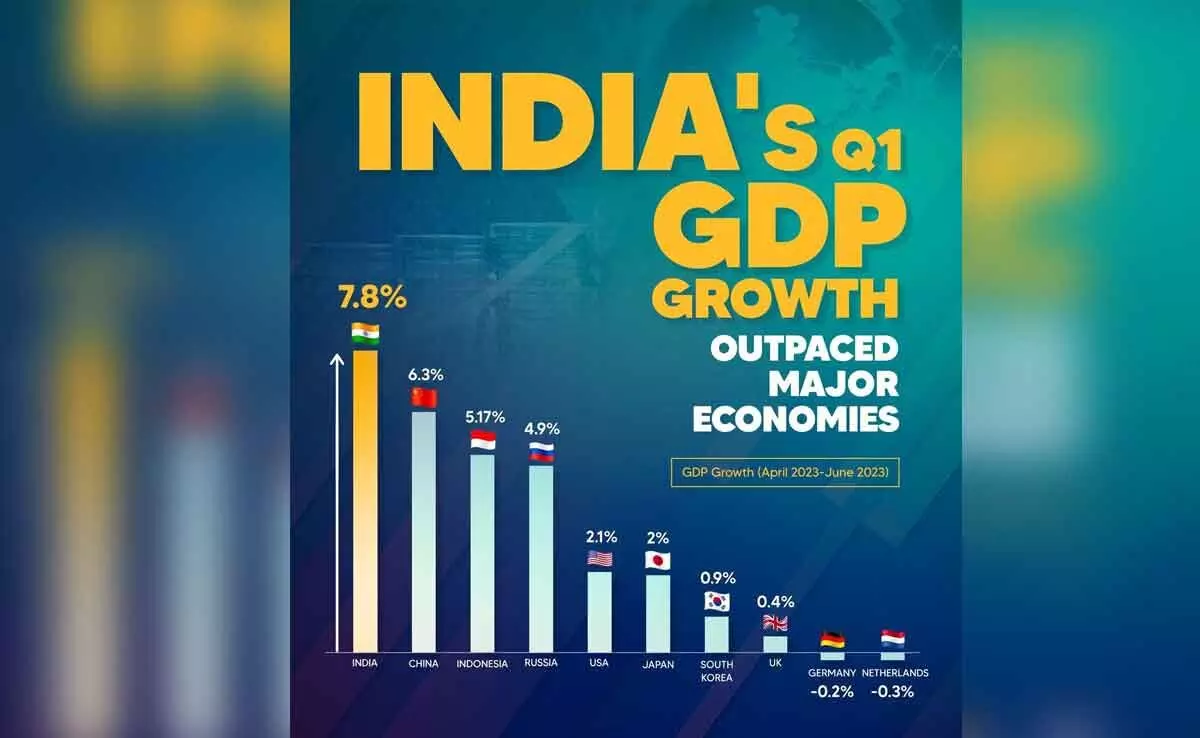

With its 7.6% growth in the last quarter, India has outperformed all major economies

image for illustrative purpose

In an encouraging development, exports, in spite of global trade slow down, registered a positive growth of 3.6% for the first half against the substantial growth of 24.3% last half. Imports have come down substantially during this period from 37.1 % in the last half to negative 6.5 %

The estimated Gross Domestic Product (GDP) for the second quarter of 2023-24, released by the Union Ministry of Statistics & Programme Implementation showed a positive surprise that India's GDP has grown at 7.6 per cent for Q2 2024 after registering a growth of 7.8 per cent for Q1 2024. This is in line with what RBI Governor Shaktikanta Das had indicated earlier and higher than the RBI forecast of 6.5 per cent.

The consecutive growth of 7.8 per cent and 7.6 per cent for the first two quarters for the current financial year, gives an average first half yearly growth of 7.7 per cent, which is an encouraging sign in the current trend of global slowdown and lesser global growth expected for the current year.

India had achieved a GDP growth of 13.1 and 6.2 per cent in the first two quarters of last year.

While the IMF projected a GDP growth of 6.3 per cent for 2023-24 for India, the half yearly GDP growth of 7.7 per cent is an encouraging growth trajectory. This is more so considering the negative growth of 5.8 per cent in Fy 2021 due to Covid-19. Today, the back-on-track performance raises optimism that India poised to be among few nations showing consistent higher growth.

According to Bank of Baroda Research, the GDP growth of 7.6 per cent for the quarter ended September 2023 indicates that India has outperformed all major countries.

Among other developed nations, the US performed better at 2.8 per cent, which is much below India’s performance. China's economy has been moderating due to real estate high debt concern and a growth of 4.9 per cent, while Germany had a negative growth of 0.8 percent and Saudi Arabia had a negative at 4.5 per cent.

However, the world GDP growth estimated by IMF in their October 2023 outlook at a lower level of three percent, advanced economies at 1.5 per cent and emerging market and developing economies at four per cent will have an impact on our economy, especially in terms of global demand for exports and global trade.

While analysing India's GDP growth, agriculture growth has come down from 3.5 per cent in the first quarter to 1.2 per cent. Even for the first half year it remained static at 2.4 per cent. Agriculture, livestock, forestry & fishing GVA at basic prices for H1 (April- September 2023-24) had only 5.7% change over the previous year as compared to 15.1% change in 2022-23. This is due to deficit rainfall, EL Nino conditions and agricultural production. The low agricultural income also affects the purchasing power in the interiors and hence the urgency to rectify the situation.

The sectors which performed well and contributed to the higher growth include mining & quarrying at 10% for H1 2023-24 against 5.8% for 2022-23; manufacturing at 13.9 against 4.7; electricity and gas at 10.1 against 2.9; construction at 13.3 against 7.9; IIP mining at 11.5 against -0.9; manufacturing at 6.2 against 1.5; metallic minerals at 14.3 against negative 11.7. This is further substantiated by the fact that India's November manufacturing PMI rose to 56.0 as against 55.5 in October. Manufacturing sector is also gaining in terms of profit margin as the input cost are way lower and the rise has been at the slowest pace in 40 months.

Other than agriculture, trade, hotels, transport. Communication and services related to broadcasting registered a growth of 4.8 % in H1 2023-24 against the corresponding period of last year at 7.7 per cent. In an encouraging development, exports, in spite of global trade slow down, registered a positive growth of 3.6% for the first half against the substantial growth of 24.3% last half. Imports have come down substantially during this period from 37.1 % in the last half to negative 6.5 %. Apart from domestic demand, international trade adds to the GDP growth while import of raw material and capital goods add to manufacture’s growth. It is therefore imperative to boost our global trade.

It is worth noting that the government has been focusing on increased capex with the target of Rs. 10 lakh crore for the current year and monitors the utilisation of respective government departments and tries to advance the capex to get multiple benefits.

Meanwhile, private investments have started towards capex, albeit at a limited level. That is how gross fixed capital Formation (GFCF) share in GDP is at 35.0 for 2023-24 as against 34.4 in 2022-23. In nominal terms, investment to GDP ratio at 31.7% in Q2 was the highest in the last 35 quarters, according to NSE research.

Another favourable aspect is that for the fourth time, gross GST collection crossed Rs. 1.60 lakh crore- mark in FY 2023-24. The gross GST collection for the first half of the year FY 2023-24 ending September 2923 at Rs. 9.92.508 crore is 11% higher than the gross GST collection in the first half of FY 2022-23 at Rs. 8,93,334 crore. The average monthly gross collection in FY 2023-24 is 1.65 lakh crore which is 11% higher than the average monthly gross collection for the first half of FY 2022-23 at Rs 1.49 lakh crore. GST collection for November 2024 at Rs. 1,67,929 crore records highest growth of 15% Y-o-Y and exceeds Rs. 1.60 lakh crore for the six time in FY 2023-24. This also indicates better growth prospects and contributes to better fiscal situation.

Looking at the current trends, India will outperform its own esteemed growth of 6.5 percent and it remains to be seen if it can repeat last year's growth of above 7 per cent.

From the domestic perspective, the challenges are persistence of weak rural demand, food prices going up thereby adding to inflation and reduced purchase power. Therefore we must not get too enthusiastic with the current high growth and ensure that all sectors register higher growth to help sustain and enhance India's GDP growth.

(The author is former Chairman & Managing Director of Indian Overseas Bank)